Safe Haven Gold: Preserving Wealth in Uncertain Times

Navigating Economic Uncertainties with Safe Haven Gold

In times of economic turbulence, investors often turn to Safe Haven Gold as a reliable asset for preserving wealth. This article delves into the characteristics that make gold a safe haven and explores its role in safeguarding wealth during uncertain times.

Understanding the Concept of Safe Haven Assets

Safe haven assets are those that retain or increase in value during times of economic downturns or geopolitical uncertainties. Gold has long been recognized as a quintessential safe haven due to its intrinsic value, scarcity, and historical significance. Understanding the concept of safe haven assets lays the foundation for comprehending gold’s role in wealth preservation.

Gold as a Hedge Against Inflation and Currency Risks

One of the primary reasons investors consider gold a safe haven is its ability to act as a hedge against inflation and currency risks. In times when fiat currencies may depreciate due to inflation or geopolitical factors, gold often maintains its value. Investors allocate a portion of their portfolios to gold to mitigate the risks associated with currency devaluation.

Geopolitical Turmoil and the Allure of Safe Haven Gold

Geopolitical uncertainties, such as international conflicts or political instability, have a direct impact on financial markets. In such scenarios, Safe Haven Gold becomes particularly attractive to investors seeking stability. The metal’s historical role as a store of value and its lack of reliance on any specific government make it a preferred choice during times of geopolitical turmoil.

Market Volatility and Gold’s Resilience

Market volatility is an inherent feature of financial markets, and gold has demonstrated resilience in the face of such volatility. When traditional investments experience sharp declines, gold often remains stable or even appreciates in value. This resilience makes gold an appealing option for investors looking to navigate the ups and downs of financial markets.

Diversification Strategies with Gold Investments

In constructing a robust investment portfolio, diversification is key. Including Safe Haven Gold in a diversified portfolio provides a counterbalance to other assets that may be more susceptible to economic downturns. Gold’s low correlation with traditional financial assets enhances its effectiveness as a diversification tool, helping to mitigate overall portfolio risk.

The Role of Central Banks in Gold Reserves

Central banks worldwide recognize the value of gold as a safe haven asset. Many central banks maintain substantial gold reserves as part of their overall asset allocation strategy. The accumulation of gold reserves by central banks further underscores the metal’s significance in times of economic uncertainty.

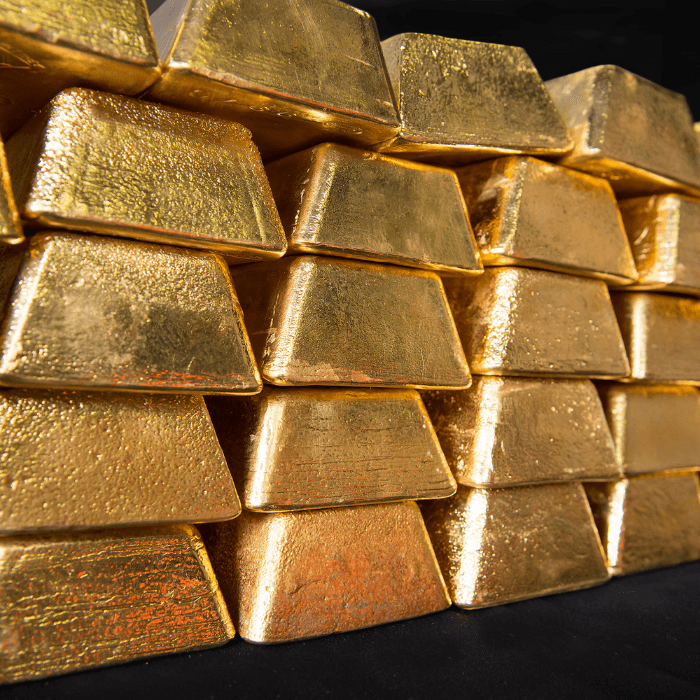

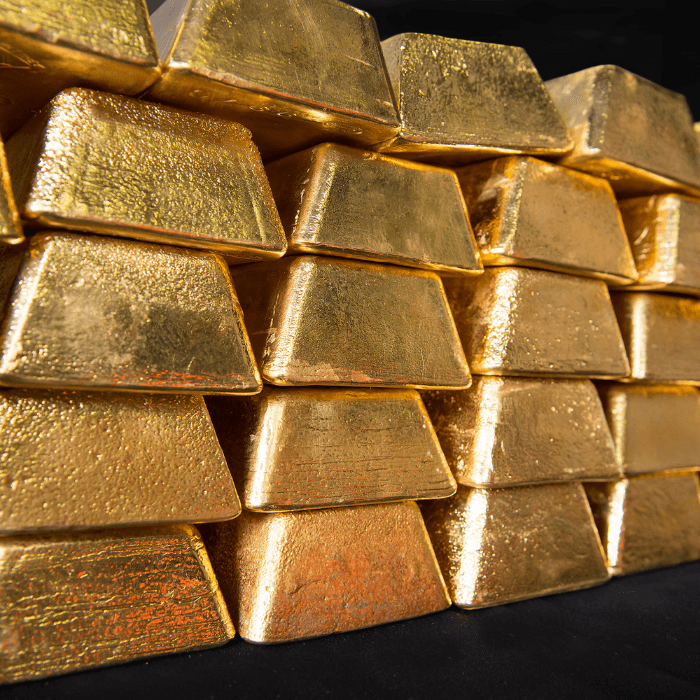

Individual Investors and Physical Gold Ownership

Beyond central banks, individual investors often choose physical gold ownership as a means of accessing Safe Haven Gold. Owning physical gold, whether in the form of coins, bars, or bullion, provides a tangible and secure asset that can be held outside the traditional financial system. This direct ownership is appealing to those who seek maximum control over their safe haven assets.

Gold-backed Securities and Financial Instruments

In addition to physical ownership, investors can access Safe Haven Gold through gold-backed securities and financial instruments. Exchange-Traded Funds (ETFs) and other investment products backed by physical gold provide a convenient way for investors to gain exposure to gold’s safe haven properties without the need for direct ownership and storage.

Conclusion: Safe Haven Gold as a Cornerstone of Financial Security

In conclusion, Safe Haven Gold plays a vital role as a cornerstone of financial security during uncertain times. Whether chosen by central banks or individual investors, the enduring appeal of gold as a store of value and a hedge against economic uncertainties underscores its significance in wealth preservation strategies.

For more insights on Safe Haven Gold, visit myshirtmaker.net.