Navigating Gold Price Volatility for Smart Investments

Deciphering the Dynamics: Navigating Gold Price Volatility

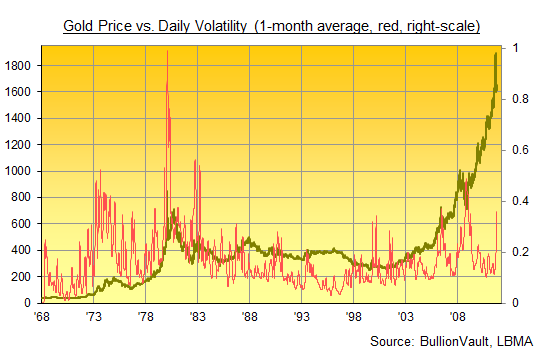

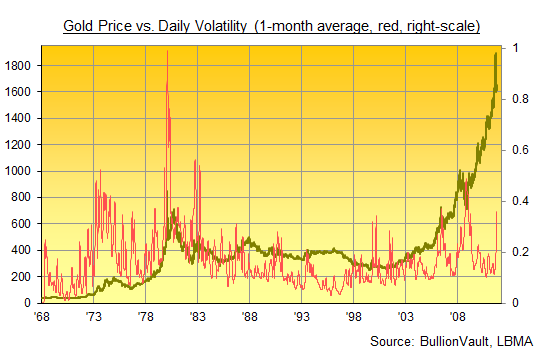

The realm of gold investments is not for the faint-hearted, especially considering the inherent volatility in gold prices. In this exploration, we’ll delve into the nuances of gold price volatility and strategies to navigate this unpredictable landscape for smart and strategic investments.

Understanding Gold Price Volatility

Gold price volatility refers to the degree of variation in the price of gold over time. Unlike some stable investments, gold prices can experience significant fluctuations in response to various economic, geopolitical, and market factors. Understanding the nature of this volatility is crucial for investors aiming to capitalize on its potential.

Economic Factors Driving Volatility

One of the primary drivers of gold price volatility is its sensitivity to economic conditions. Economic uncertainties, inflation rates, and interest rate changes can trigger fluctuations in gold prices. Investors need to stay vigilant, closely monitoring economic indicators to anticipate potential shifts in the gold market.

Geopolitical Events and Market Sentiments

Gold, often seen as a safe-haven asset, reacts strongly to geopolitical events and market sentiments. Political unrest, trade tensions, or global crises can lead to a surge in demand for gold, driving up prices. Investors navigating gold price volatility must keep a watchful eye on global events and market sentiments to make informed decisions.

The Role of Speculation and Investor Behavior

Speculation and investor behavior contribute significantly to gold price volatility. Market sentiments, herd behavior, and speculative trading can lead to rapid price movements. Investors need to be mindful of these factors, recognizing that emotional responses and speculative activities can amplify volatility.

Strategies for Navigating Volatility

Navigating gold price volatility requires a strategic approach. Diversification, risk management, and staying informed are essential strategies. Diversifying a portfolio across different asset classes can help mitigate the impact of gold price fluctuations. Additionally, setting clear risk tolerance levels and employing risk management techniques are crucial for managing volatility.

Long-Term Investing as a Hedge

While gold prices can be volatile in the short term, adopting a long-term investment perspective can serve as a hedge against volatility. Historically, gold has shown resilience over extended periods, preserving wealth and providing a store of value. Long-term investors can ride out short-term fluctuations for potentially favorable returns.

Utilizing Derivatives and Hedging Instruments

Sophisticated investors often use derivatives and hedging instruments to navigate gold price volatility. Options, futures contracts, and other financial derivatives can provide a means to hedge against potential losses or take advantage of price movements. However, it’s crucial for investors to thoroughly understand these instruments before incorporating them into their strategies.

Staying Informed in Real-Time

In the fast-paced world of financial markets, staying informed in real-time is essential for navigating gold price volatility. Access to up-to-the-minute market information, economic indicators, and global news is invaluable. Utilizing reliable sources and technology to stay informed empowers investors to make timely and well-informed decisions.

The Impact of Central Bank Policies

Central bank policies, particularly regarding interest rates and monetary stimulus, can have a significant impact on gold prices. Changes in these policies can influence investor perceptions and market dynamics, contributing to gold price volatility. Investors should closely monitor central bank announcements for potential clues about future gold market movements.

Striking a Balance for Optimal Returns

In conclusion, while gold price volatility poses challenges, it also presents opportunities for strategic investors. Striking a balance between risk and potential returns, understanding the factors that drive volatility, and implementing sound investment strategies are key. For further insights into navigating gold price volatility, visit Gold Price Volatility, where additional resources can enhance your understanding and guide you toward smart investment decisions.