Golden Tactics: Mastering Effective Gold Trading Strategies

Strategizing Success: Unveiling Effective Gold Trading Strategies

Embarking on the exhilarating journey of gold trading demands a keen understanding of the market’s dynamics and a strategic approach. This article unveils key Gold Trading Strategies, providing insights for both novice and experienced traders aiming to master the art of navigating the gold market with confidence and precision.

Understanding Market Trends: The Foundation of Strategy

A fundamental aspect of effective Gold Trading Strategies is a thorough understanding of market trends. Traders who grasp the nuances of price movements, support and resistance levels, and chart patterns can make informed decisions. Analyzing historical data and identifying recurring trends empower traders to devise strategies that capitalize on predictable market behaviors.

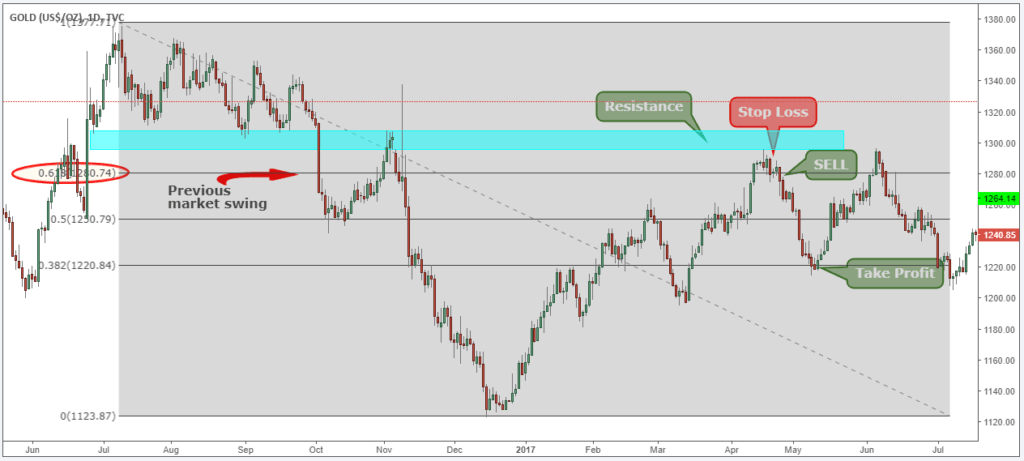

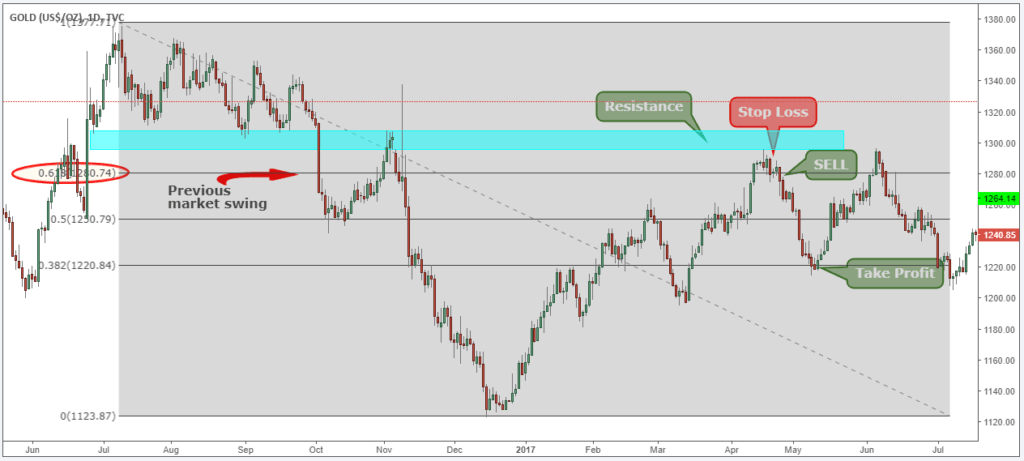

Technical Analysis: Deciphering Price Charts

Technical Analysis stands as a cornerstone for many successful Gold Trading Strategies. Utilizing tools like moving averages, trendlines, and indicators such as Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) enables traders to decipher price charts. Technical analysis aids in spotting potential entry and exit points, enhancing decision-making accuracy.

Gold Trading Strategies often involve technical analysis for deciphering price charts.

Risk Management: Safeguarding Capital

Effectively managing risk is a critical component of successful Gold Trading Strategies. Traders employ risk management techniques such as setting stop-loss orders, diversifying their portfolios, and determining position sizes relative to their overall capital. A robust risk management strategy ensures that traders safeguard their capital and maintain longevity in the volatile gold market.

Favorable Economic Indicators: Informed Decision-Making

Keeping a watchful eye on economic indicators is paramount in Gold Trading Strategies. Factors such as interest rates, inflation, and employment data can significantly influence gold prices. Traders who incorporate a macroeconomic perspective into their strategies make more informed decisions, aligning their trades with broader economic trends.

Long-Term vs. Short-Term Trading: Choosing a Path

Gold Trading Strategies often diverge based on the trader’s time horizon—long-term or short-term. Long-term traders may adopt a buy-and-hold approach, relying on the metal’s historical resilience as a store of value. Short-term traders, on the other hand, may capitalize on intraday price movements, leveraging volatility for quick gains. Choosing the appropriate trading path aligns with individual preferences and risk tolerance.

Fundamental Analysis: Digging into Market Fundamentals

Beyond technical analysis, successful Gold Trading Strategies frequently integrate fundamental analysis. Examining factors like central bank policies, geopolitical events, and mining industry developments provides a comprehensive view. Fundamental analysis empowers traders to anticipate market movements driven by broader economic and geopolitical forces.

Leveraging Leverage: Caution and Opportunity

While leverage can amplify profits, it also introduces heightened risk. Effective Gold Trading Strategies carefully navigate the use of leverage. Traders assess their risk tolerance and employ leverage judiciously, understanding that while it can magnify gains, it can equally accentuate losses. Leveraging leverage demands a cautious and strategic approach.

Psychology of Trading: Emotions and Discipline

The psychology of trading plays a crucial role in effective Gold Trading Strategies. Emotions like fear and greed can cloud judgment and lead to impulsive decisions. Successful traders cultivate discipline, patience, and emotional resilience. Developing a mindset that withstands the emotional highs and lows of trading is essential for executing strategies with consistency.

Continuous Learning: Evolving with the Market

Gold Trading Strategies are not static; they evolve with the market. Traders committed to success engage in continuous learning. Staying informed about market developments, learning from both successes and failures, and adapting strategies to changing conditions contribute to a trader’s longevity and effectiveness in the gold market.

Conclusion: Crafting Your Gold Trading Success

In conclusion, effective Gold Trading Strategies require a holistic approach that encompasses technical and fundamental analysis, risk management, and an understanding of market psychology. Traders must navigate the ever-changing market dynamics, continuously refine their strategies, and stay attuned to economic indicators. By mastering these key elements, traders can craft their path to success in the exhilarating world of gold trading.