Golden Rollercoaster: Navigating Gold Price Volatility

Riding the Waves: Understanding and Profiting from Gold Price Volatility

Embarking on the journey of gold investment, one must grasp the nuances of Gold Price Volatility. This article unravels the dynamics of gold price fluctuations, offering insights into the factors driving volatility and strategies for investors looking to navigate the unpredictable waves of the gold market with finesse.

The Nature of Gold Price Volatility: A Brief Overview

Gold Price Volatility refers to the degree of variation in gold prices over time. Unlike some stable investments, gold is known for its price swings influenced by various factors. Understanding the nature of this volatility is essential for investors, as it shapes the risk and reward landscape of gold investments.

Market Forces at Play: Unraveling the Factors

Gold Price Volatility is a result of several market forces at play. Factors such as geopolitical events, economic data releases, central bank policies, and currency fluctuations contribute to the ebb and flow of gold prices. Investors need to dissect these elements to anticipate potential volatility and make informed investment decisions.

Gold Price Volatility is influenced by various market forces shaping its dynamics.

Geopolitical Unrest: A Catalyst for Fluctuations

Geopolitical events have a profound impact on Gold Price Volatility. Political tensions, trade disputes, and global unrest can trigger a flight to safety, leading investors to seek refuge in gold. Consequently, these events create spikes in demand, influencing gold prices and introducing volatility into the market.

Economic Indicators: Paving the Way for Swings

Economic indicators play a crucial role in influencing Gold Price Volatility. Reports on inflation, interest rates, and employment figures can sway investor sentiment and impact the demand for gold. Traders keen on understanding and profiting from gold price fluctuations closely monitor these economic indicators to anticipate potential volatility.

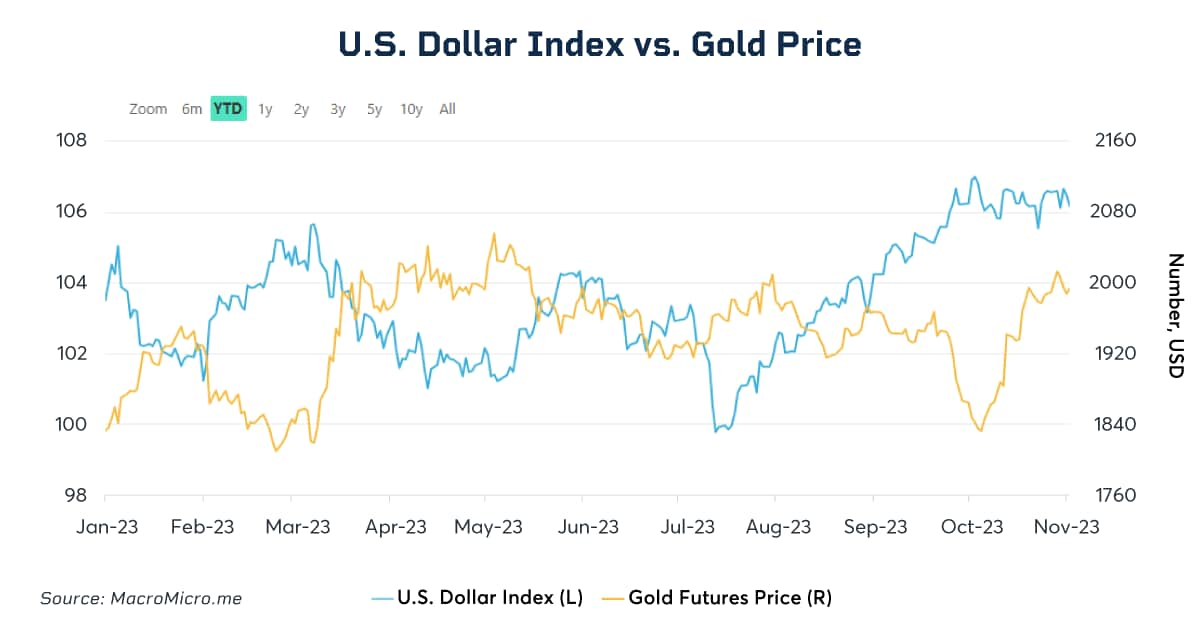

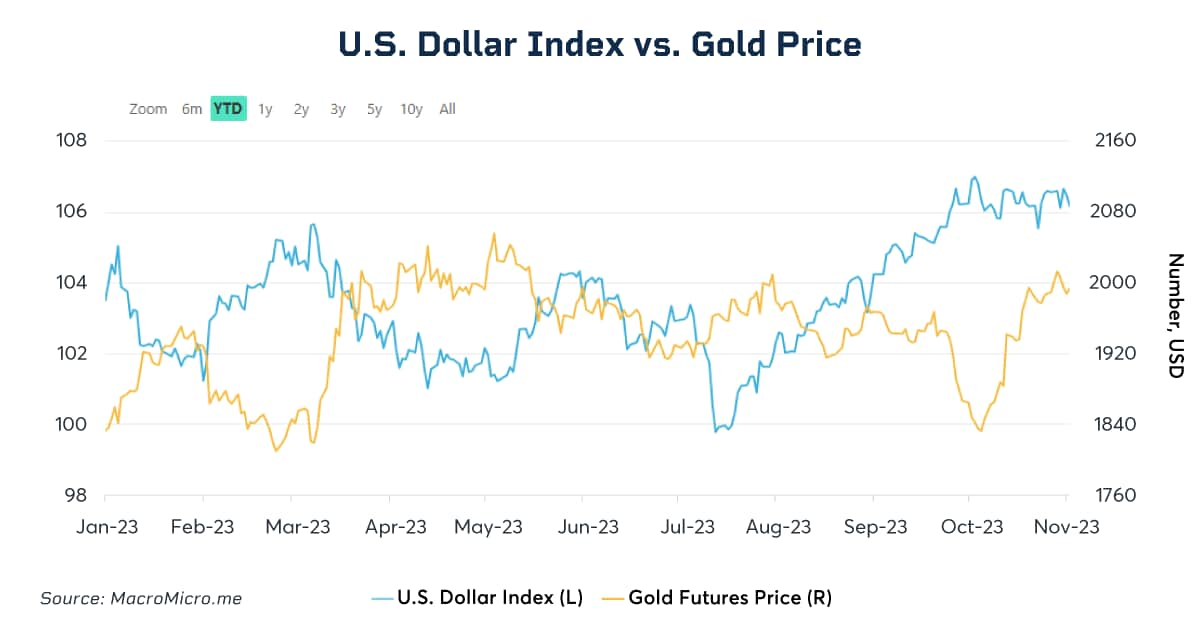

Currency Movements: A Dance with Gold Prices

The relationship between currencies and gold prices adds another layer to Gold Price Volatility. The U.S. dollar, in particular, tends to have an inverse correlation with gold. When the dollar strengthens, gold prices may decline, and vice versa. Investors tracking currency movements can gain insights into potential shifts in gold price dynamics.

Investor Sentiment: Shaping Market Swings

The psychology of investors significantly contributes to Gold Price Volatility. Fear, uncertainty, and market sentiment can trigger rapid buying or selling of gold, leading to price swings. Understanding investor sentiment and market psychology becomes paramount for investors aiming to navigate and capitalize on gold price fluctuations.

Mining Industry Dynamics: Supply-Side Influences

The operations of the gold mining industry impact Gold Price Volatility. Developments such as new discoveries, production disruptions, or changes in mining regulations can influence the overall supply of gold. Investors assessing the dynamics of the mining industry gain insights into potential shifts in gold prices and subsequent volatility.

Risk Management Strategies: Mitigating the Impact

For investors navigating the unpredictable seas of Gold Price Volatility, implementing effective risk management strategies is crucial. Setting stop-loss orders, diversifying portfolios, and carefully considering position sizes help mitigate the impact of sudden price swings, ensuring that investors can weather market fluctuations with resilience.

Leveraging Volatility: Strategies for Investors

While Gold Price Volatility introduces risks, it also presents opportunities for savvy investors. Some traders actively seek to capitalize on volatility by engaging in short-term trading, options trading, or leveraging derivative instruments. These strategies require a deep understanding of market dynamics and risk tolerance.

Long-Term Perspective: Weathering the Storm

For investors with a long-term perspective, Gold Price Volatility can be viewed as part of the natural cycle. Historically, gold has shown resilience and acted as a store of value. Investors with a patient approach may choose to weather short-term volatility, confident in gold’s enduring appeal over the long run.

Conclusion: Navigating the Turbulence with Finesse

In conclusion, understanding and navigating Gold Price Volatility is an integral aspect of successful gold investment. By dissecting the market forces, monitoring geopolitical events, economic indicators, and investor sentiment, and implementing effective risk management strategies, investors can navigate the turbulence with finesse. Whether seizing short-term opportunities or adopting a long-term perspective, informed decision-making is the key to mastering the unpredictable waves of gold price fluctuations.