Golden Opportunities: Strategies for Investing in Gold

Unlocking Potential: Navigating Strategies for Investing in Gold

Investing in gold has been a time-honored strategy for preserving wealth and diversifying portfolios. In this exploration, we delve into the various facets of investing in gold, exploring its historical significance, current trends, and strategies for optimizing returns.

The Historical Significance of Gold as an Investment

Gold has maintained its allure throughout history, serving as a store of value and a hedge against economic uncertainties. Understanding the historical significance of gold as an investment lays the groundwork for appreciating its enduring role in diversified portfolios.

Diversification Benefits and Risk Mitigation

One of the primary reasons investors turn to gold is its diversification benefits. Gold often exhibits a low correlation with traditional asset classes like stocks and bonds. Incorporating gold into a diversified portfolio can help mitigate risk and enhance overall stability, especially during periods of market volatility.

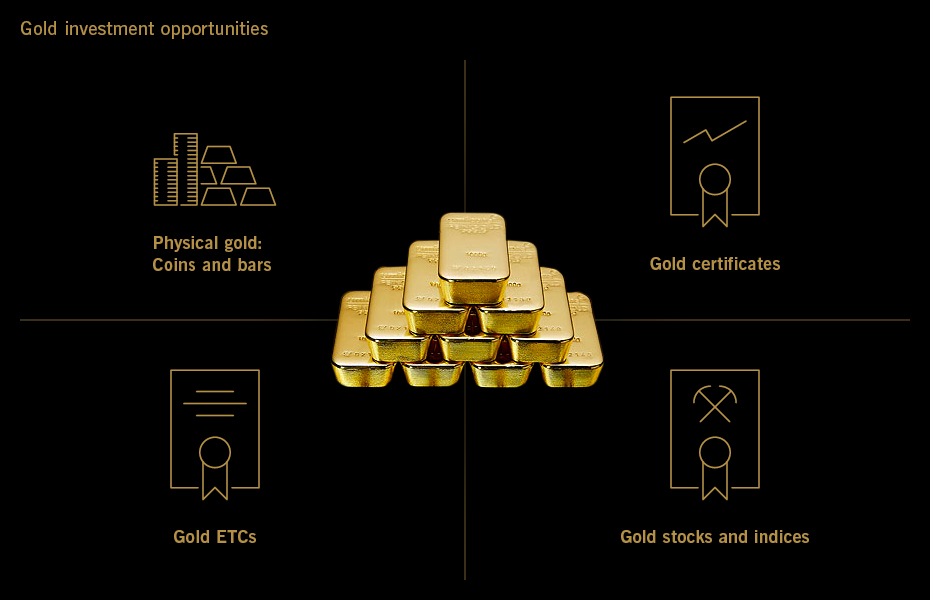

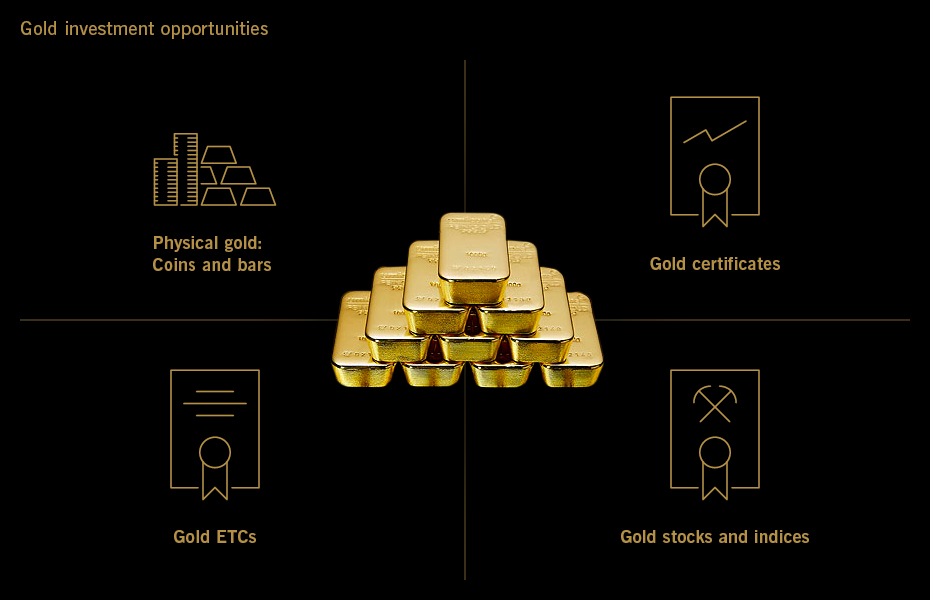

Strategies for Physical Gold Investment

Investors can opt for physical gold investment by purchasing gold coins, bars, or jewelry. Owning physical gold provides a tangible asset that is not subject to counterparty risk. However, storage and security considerations should be evaluated when choosing this form of gold investment.

Gold Exchange-Traded Funds (ETFs) for Accessibility

Gold ETFs offer a convenient way to invest in gold without the need for physical possession. These investment vehicles are traded on stock exchanges, providing investors with the flexibility to buy and sell shares at market prices. Gold ETFs are known for their liquidity and ease of entry into the gold market.

Mining Stocks and Exposure to Gold Industry

Investors seeking exposure to the gold industry often consider mining stocks. Investing in gold mining companies allows participation in the potential profitability of the industry. However, it comes with additional considerations such as company performance, management, and geopolitical factors affecting mining operations.

Futures and Options Contracts for Sophisticated Investors

Sophisticated investors may explore futures and options contracts to gain exposure to gold price movements. These financial derivatives allow investors to speculate on future gold prices or hedge against potential downside risks. However, trading in derivatives requires a deep understanding of the market and risk management.

Factors Influencing Gold Prices and Investment Decisions

Several factors influence gold prices, including economic indicators, geopolitical events, and currency movements. Keeping a close eye on these factors is essential for making informed investment decisions. Understanding the dynamics of the gold market empowers investors to navigate fluctuations and identify opportune moments.

Risk Management Strategies in Gold Investing

As with any investment, risk management is paramount when investing in gold. While gold is considered a relatively stable asset, market conditions can vary. Implementing risk management strategies, such as diversification, setting clear investment goals, and staying informed about market trends, helps safeguard investment portfolios.

The Role of Gold in Economic Downturns

Gold has historically been viewed as a safe-haven asset, particularly during economic downturns. Investors turn to gold as a store of value when traditional markets face challenges. Understanding the role of gold in economic downturns informs investors about its potential resilience in times of crisis.

Long-Term Potential and Future Outlook for Gold Investments

Considering the long-term potential of gold is crucial for investors with a strategic investment horizon. Historical performance suggests that gold has preserved wealth over time. Examining the future outlook for gold investments involves assessing global economic trends, technological advancements, and evolving investor sentiments.

To explore further insights into investing in gold, visit Investing in Gold. This resource provides additional tools and perspectives to assist investors in making informed decisions as they navigate the diverse strategies for investing in gold and unlocking its potential in their portfolios.