Gold Price Fluctuations: Navigating Market Volatility

Riding the Waves: Understanding Gold Price Fluctuations

In the dynamic landscape of financial markets, gold price fluctuations are a common phenomenon. Investors keen on harnessing the full potential of precious metals need to navigate these fluctuations strategically. This article explores the various factors influencing gold prices and offers insights for investors seeking to understand and leverage market volatility.

Market Forces at Play: Unraveling the Complexity

Gold price fluctuations are influenced by a myriad of market forces, and understanding these complexities is essential. Factors such as supply and demand dynamics, geopolitical events, economic indicators, and investor sentiment all contribute to the ebb and flow of gold prices. Unraveling this complexity is the first step in navigating the intricacies of the gold market.

Supply and Demand: A Balancing Act

At the core of gold price fluctuations lies the delicate balance between supply and demand. Changes in mining production, central bank reserves, and consumer demand contribute to the constant fluctuation in gold prices. Investors monitoring these dynamics gain insights into potential shifts in the market, allowing them to make informed decisions.

Geopolitical Events: Catalysts for Movement

Geopolitical events often act as catalysts for significant gold price fluctuations. Political unrest, trade tensions, and global crises can create an environment of uncertainty, prompting investors to turn to gold as a safe-haven asset. Understanding how geopolitical events influence market sentiment is crucial for predicting and reacting to price movements.

Economic Indicators: Impact on Gold Values

Economic indicators, such as interest rates, inflation rates, and currency values, play a substantial role in gold price fluctuations. Changes in these indicators can influence investor perceptions of risk and impact the demand for gold. Investors closely monitoring economic trends can position themselves strategically to capitalize on price movements.

Investor Sentiment: Shaping Market Trends

The sentiment of investors contributes significantly to gold price fluctuations. Whether driven by fear, optimism, or risk aversion, investor sentiment can shape market trends. Analyzing sentiment indicators provides valuable insights into the prevailing mood of the market, allowing investors to align their strategies with the broader investment community.

Central Bank Policies: Impact on Gold Reserves

Central banks’ policies and decisions regarding gold reserves can have a substantial impact on gold prices. Changes in central bank buying or selling of gold influence market perceptions of the metal’s value. Investors keeping a close eye on central bank activities gain insights into potential shifts in the gold market.

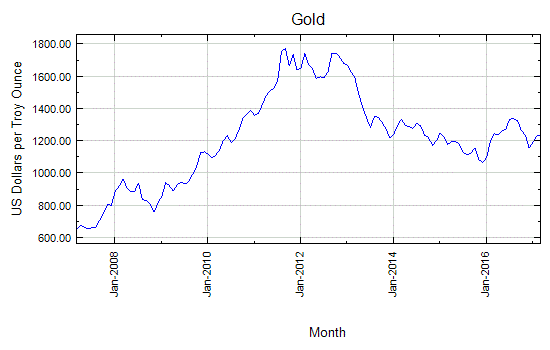

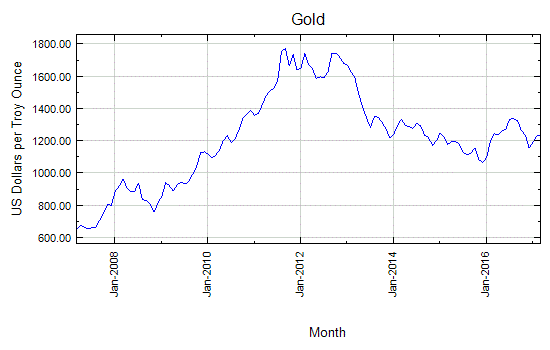

Technical Analysis: Charting Price Movements

Technical analysis involves charting historical price movements to identify patterns and trends. This approach is widely used by investors to predict potential gold price fluctuations. Understanding technical indicators and price charts empowers investors to make data-driven decisions in response to market movements.

Global Economic Conditions: A Macro Perspective

Gold price fluctuations are often reflective of broader global economic conditions. Economic downturns, recessions, or periods of economic growth can impact the demand for gold as both a safe-haven asset and an industrial commodity. Investors analyzing these macroeconomic conditions gain a macro perspective on potential future price movements.

Risk Management: Navigating Volatility Safely

Given the inherent volatility in gold prices, effective risk management is paramount for investors. Establishing risk tolerance, setting stop-loss orders, and diversifying portfolios are key strategies for navigating gold price fluctuations safely. Investors adopting a disciplined and well-thought-out risk management approach are better positioned to weather market volatility.

For those eager to delve deeper into the nuances of gold price fluctuations, Gold Price Fluctuations provide a comprehensive resource. Navigating the waves of market volatility requires a combination of market understanding, strategic insight, and a proactive approach to capitalize on the potential opportunities within the dynamic gold market.