Gold Market Dynamics: Navigating Trends for Smart Investments

Deciphering the Nuances: Understanding Gold Market Dynamics

In the intricate world of investments, comprehending gold market dynamics is essential for making informed decisions. This article explores the multifaceted aspects of gold market trends, offering insights into the factors that drive this precious metal’s value and influence strategic investment choices.

Macro Forces at Play: Global Economic Impact on Gold

Gold’s value is deeply entwined with global economic forces. Fluctuations in interest rates, inflation rates, and currency values directly impact the dynamics of the gold market. Understanding how these macroeconomic factors interplay provides investors with a foundation for predicting and reacting to changes in gold prices.

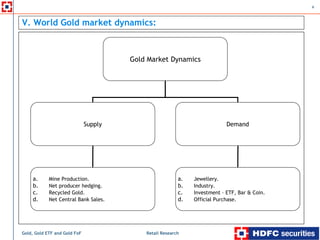

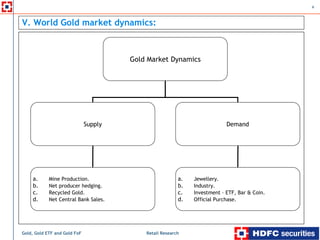

Supply and Demand Dynamics: Balancing the Scales

The age-old principles of supply and demand play a pivotal role in gold market dynamics. Changes in mining production, central bank reserves, and consumer demand contribute to the delicate equilibrium. A nuanced understanding of these dynamics enables investors to anticipate shifts in the market and position themselves accordingly.

Geopolitical Unrest: Gold as a Safe-Haven Asset

Gold has historically been a safe-haven asset during times of geopolitical turmoil. Understanding the impact of global events, such as political instability or trade tensions, on gold market dynamics allows investors to recognize opportunities for portfolio protection and capitalize on the metal’s stability during uncertain times.

Market Sentiment: The Psychological Aspect of Gold Dynamics

Investor sentiment can significantly influence gold market dynamics. During times of economic uncertainty, a surge in demand for gold often stems from the psychological need for a safe-haven. Monitoring market sentiment indicators helps investors gauge the mood of the market and make informed decisions based on prevailing attitudes.

Technological Advances: Shaping the Future of Gold

Technological innovations are shaping the dynamics of the gold market. The increasing use of gold in electronics, medical devices, and renewable energy technologies influences both demand and supply. Investors need to stay abreast of these technological shifts to anticipate changes in gold market dynamics and position themselves strategically.

Environmental Considerations: A New Dimension in Gold Dynamics

Environmental concerns have become a crucial aspect of gold market dynamics. Investors are increasingly scrutinizing the environmental practices of gold mining companies. Sustainable and responsible mining practices are gaining importance, and understanding these considerations is vital for investors aligning their portfolios with ethical and environmental values.

Cryptocurrencies and Gold: A Comparative Analysis

The rise of cryptocurrencies introduces a new element to gold market dynamics. While some view cryptocurrencies as digital gold, others see gold as a traditional, tangible asset with enduring value. Analyzing the relationship between cryptocurrencies and gold provides insights into evolving investor preferences and the broader financial landscape.

Dynamic Forecasting: Navigating Gold Price Predictions

Forecasting gold prices is a challenging endeavor, considering the myriad factors at play. Investors utilize a range of methods, including technical analysis, historical price patterns, and economic forecasting, to navigate gold market dynamics. Staying informed about diverse forecasting approaches empowers investors to make well-rounded predictions.

Gold Market Dynamics as a Guide: Strategic Decision-Making

For those navigating the complexities of the gold market, Gold Market Dynamics serves as an invaluable guide. By understanding the intricate interplay of economic, geopolitical, and technological factors, investors can make strategic decisions, optimizing their portfolios for long-term growth and stability in the ever-evolving world of gold investments.

In conclusion, a comprehensive understanding of gold market dynamics is essential for investors aiming to thrive in this dynamic environment. By delving into the macroeconomic forces, supply and demand dynamics, geopolitical influences, and emerging technological trends, investors can navigate the complexities of the gold market with confidence and make informed decisions for their investment portfolios.