Gold ETF Investments: Maximizing Precious Metal Returns

Unlocking Potential: Navigating Gold ETF Investments

In the ever-expanding landscape of investment options, Gold Exchange-Traded Funds (ETFs) stand out as a dynamic and accessible avenue for investors seeking exposure to the precious metal. This article explores the nuances of Gold ETF investments, shedding light on the benefits, considerations, and strategic approaches for those looking to maximize returns.

Understanding Gold ETFs: A Primer

Gold ETFs are financial instruments that track the price of gold. Investors buy shares of these ETFs, which represent ownership in the underlying physical gold or gold futures contracts. This direct correlation to the price of gold provides investors with a convenient and liquid way to gain exposure to the precious metal without owning physical gold.

Liquidity and Accessibility: Advantages of Gold ETFs

One of the primary advantages of Gold ETF investments is the liquidity and accessibility they offer. Traded on stock exchanges, Gold ETFs provide investors with the flexibility to buy and sell shares throughout the trading day. This ease of trading enhances liquidity, allowing investors to enter or exit positions efficiently, a feature often lacking in physical gold ownership.

Diversification Benefits: Balancing Portfolios

Gold ETFs play a significant role in portfolio diversification. Investors looking to spread risk across different asset classes appreciate the low correlation between gold and traditional investments like stocks and bonds. Integrating Gold ETFs into a diversified portfolio can enhance overall stability and mitigate risks associated with the volatility of other assets.

Cost-Effective Exposure: Minimizing Expenses

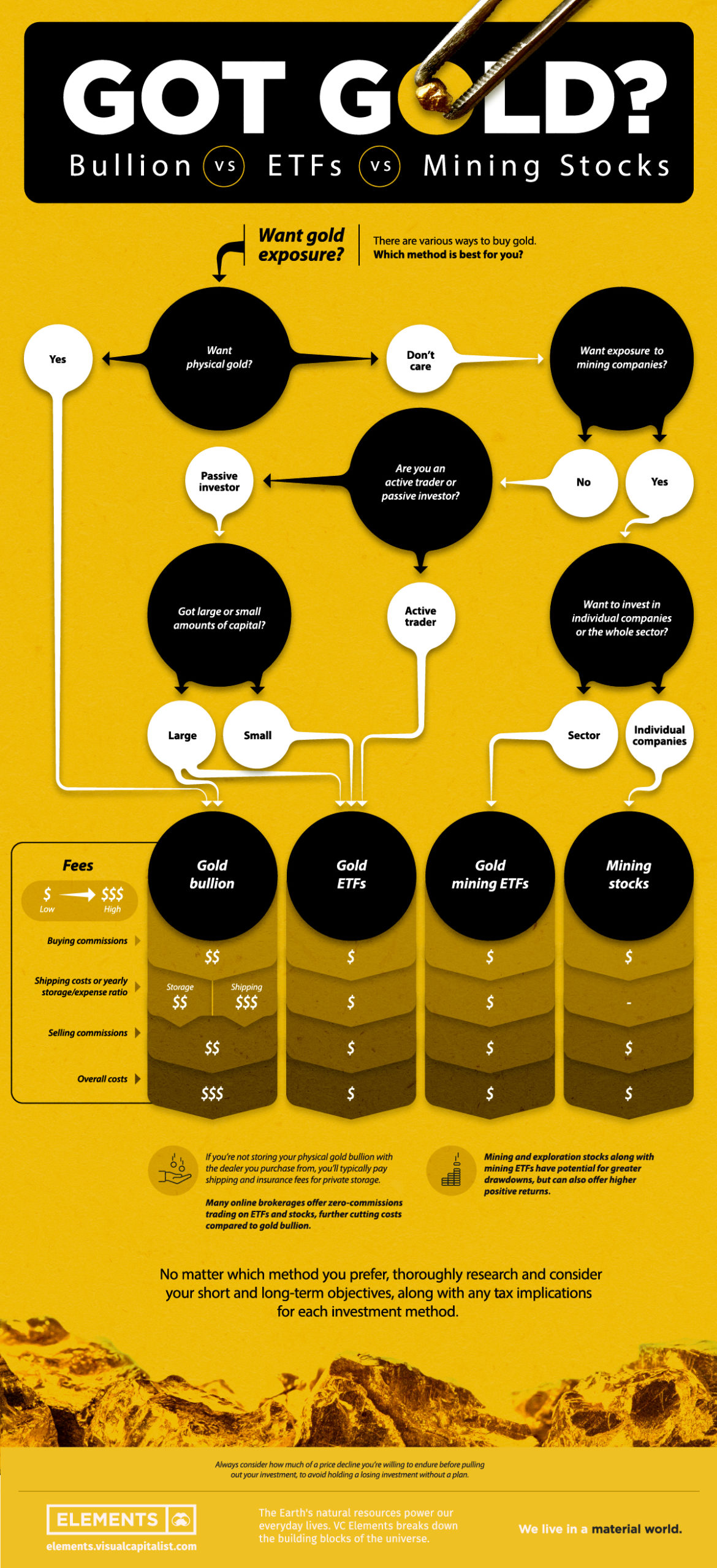

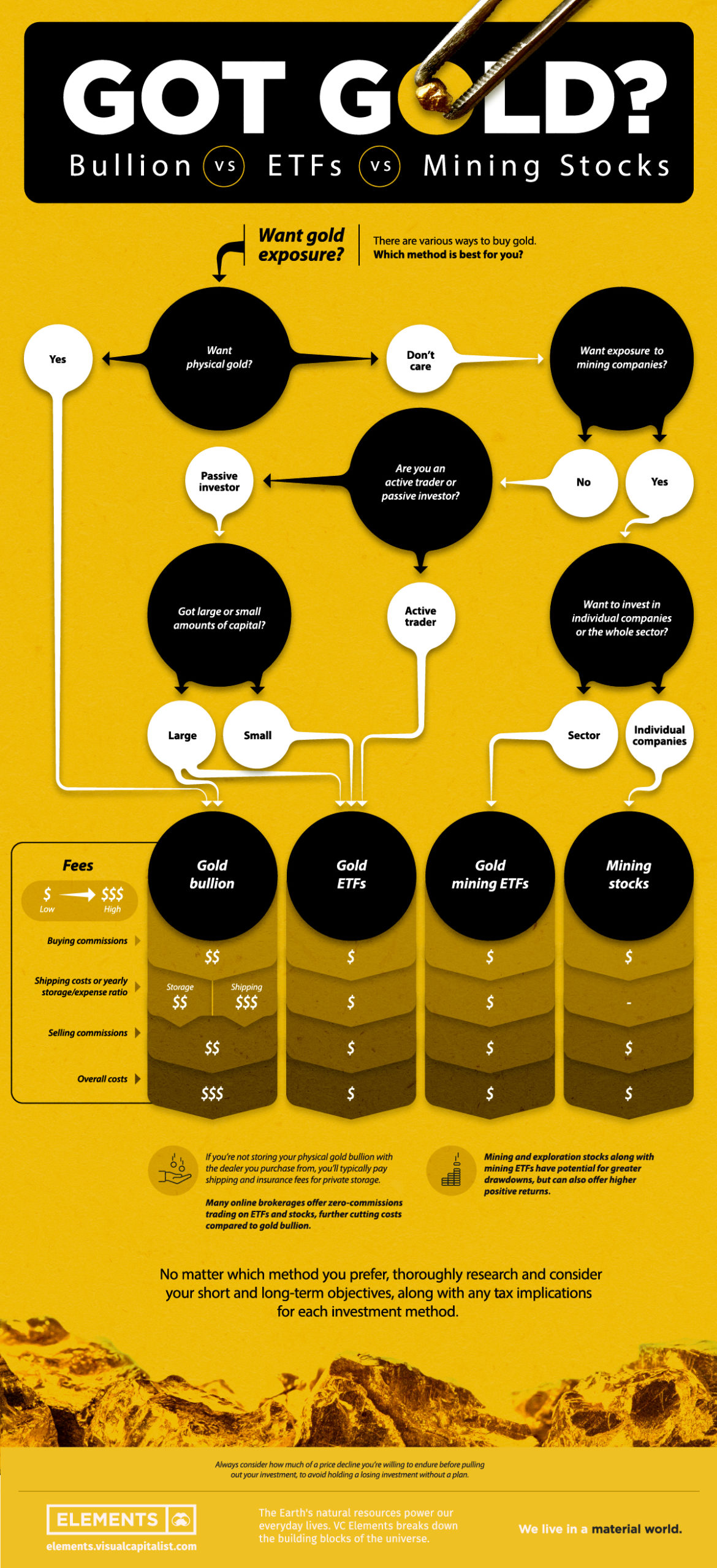

Compared to buying and storing physical gold, Gold ETF investments are often more cost-effective. Investors avoid the costs associated with buying, storing, and insuring physical gold, making Gold ETFs an efficient way to gain exposure to the precious metal. The relatively low expense ratios of ETFs further contribute to their cost-effectiveness.

Tracking Gold Prices: Real-Time Performance Monitoring

Gold ETFs track the price of gold in real-time. This transparency allows investors to monitor their investments’ performance closely. Whether through financial news, online platforms, or dedicated ETF tracking tools, investors can stay informed about gold prices and make timely decisions based on the evolving market dynamics.

Flexibility in Trading: Tailoring Investment Strategies

Gold ETF investments provide flexibility in trading that appeals to a diverse range of investors. Whether through day trading, swing trading, or long-term holding, the ability to adapt trading strategies to different market conditions makes Gold ETFs versatile instruments. Investors can tailor their approaches based on their risk tolerance and investment goals.

Risks and Considerations: Evaluating Potential Drawbacks

While Gold ETFs offer numerous benefits, investors should be aware of potential risks. Factors such as tracking errors, management fees, and exposure to market risks can impact returns. Understanding these considerations is crucial for making informed investment decisions and aligning expectations with the realities of Gold ETF investing.

Tax Efficiency: Capitalizing on Potential Advantages

Gold ETF investments can offer tax advantages compared to other forms of gold ownership. Capital gains taxes on the sale of Gold ETF shares may be more favorable than taxes on physical gold. Investors seeking tax efficiency should explore the specific tax implications associated with Gold ETFs in their respective jurisdictions.

Comparing ETFs: Choosing the Right Instrument

With various Gold ETFs available in the market, choosing the right instrument requires careful consideration. Factors such as expense ratios, tracking methods, and fund size can influence the suitability of an ETF for a particular investor. Conducting thorough research and comparing different ETFs empower investors to make well-informed choices.

Strategic Integration: Maximizing Gold ETF Potential

Successfully navigating Gold ETF investments involves strategic integration into an overall investment plan. Understanding individual financial goals, risk tolerance, and time horizons enables investors to maximize the potential benefits of Gold ETFs within their broader investment strategies.

For those ready to explore the potential of Gold ETF investments, Gold ETF Investments offer a gateway to the world of precious metal exposure with convenience, liquidity, and strategic flexibility. By unlocking the advantages and understanding the considerations, investors can embark on a journey to harness the full potential of Gold ETFs in their investment portfolios.