Forecasting Gold: Navigating the Gold Price Outlook

Deciphering Trends: Navigating the Gold Price Outlook

Understanding the Gold Price Outlook is a crucial aspect for investors seeking to make informed decisions in the ever-fluctuating landscape of financial markets. In this exploration, we delve into the various factors influencing gold prices and how investors can navigate the complexities of the gold market.

Historical Trends and Patterns

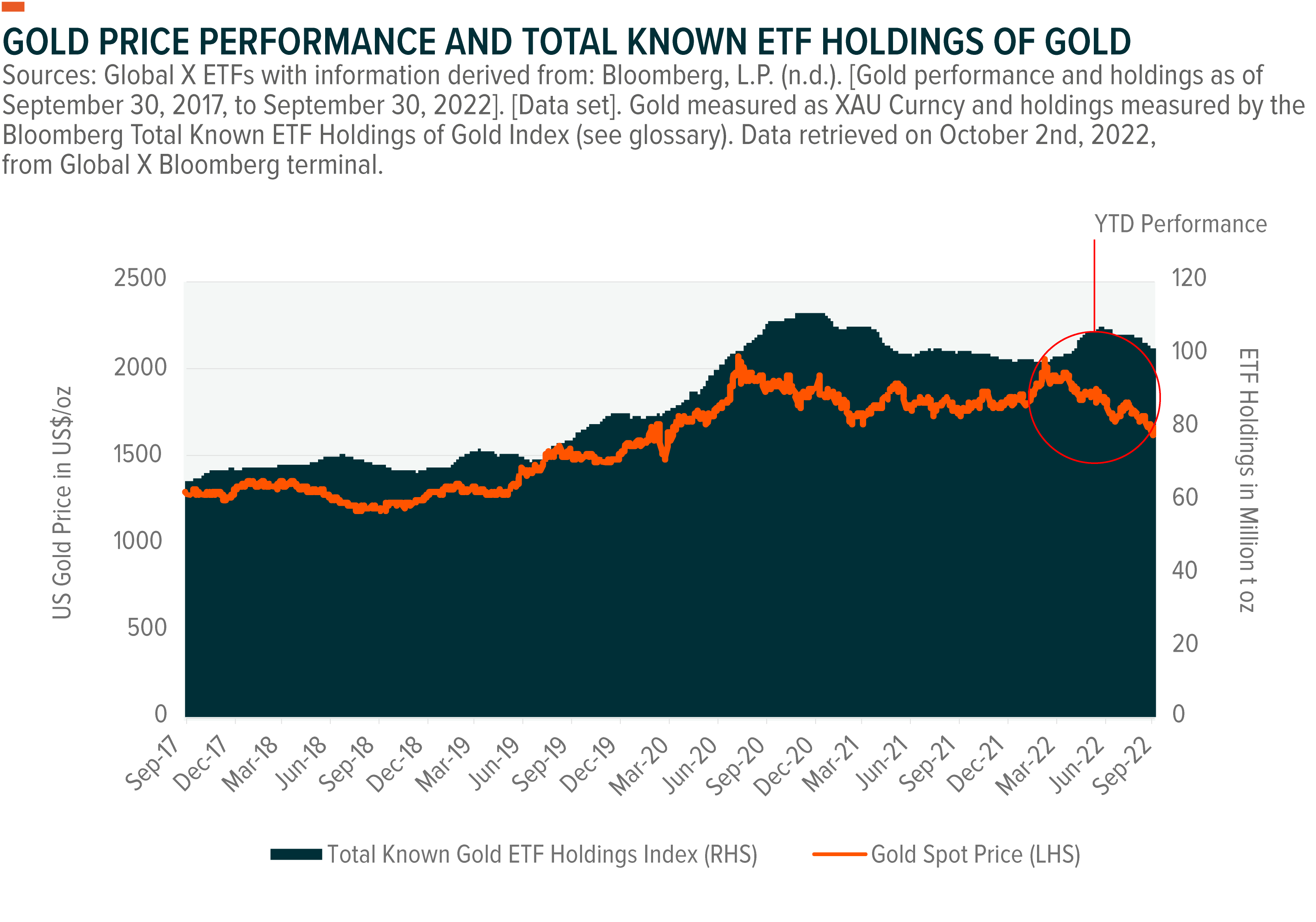

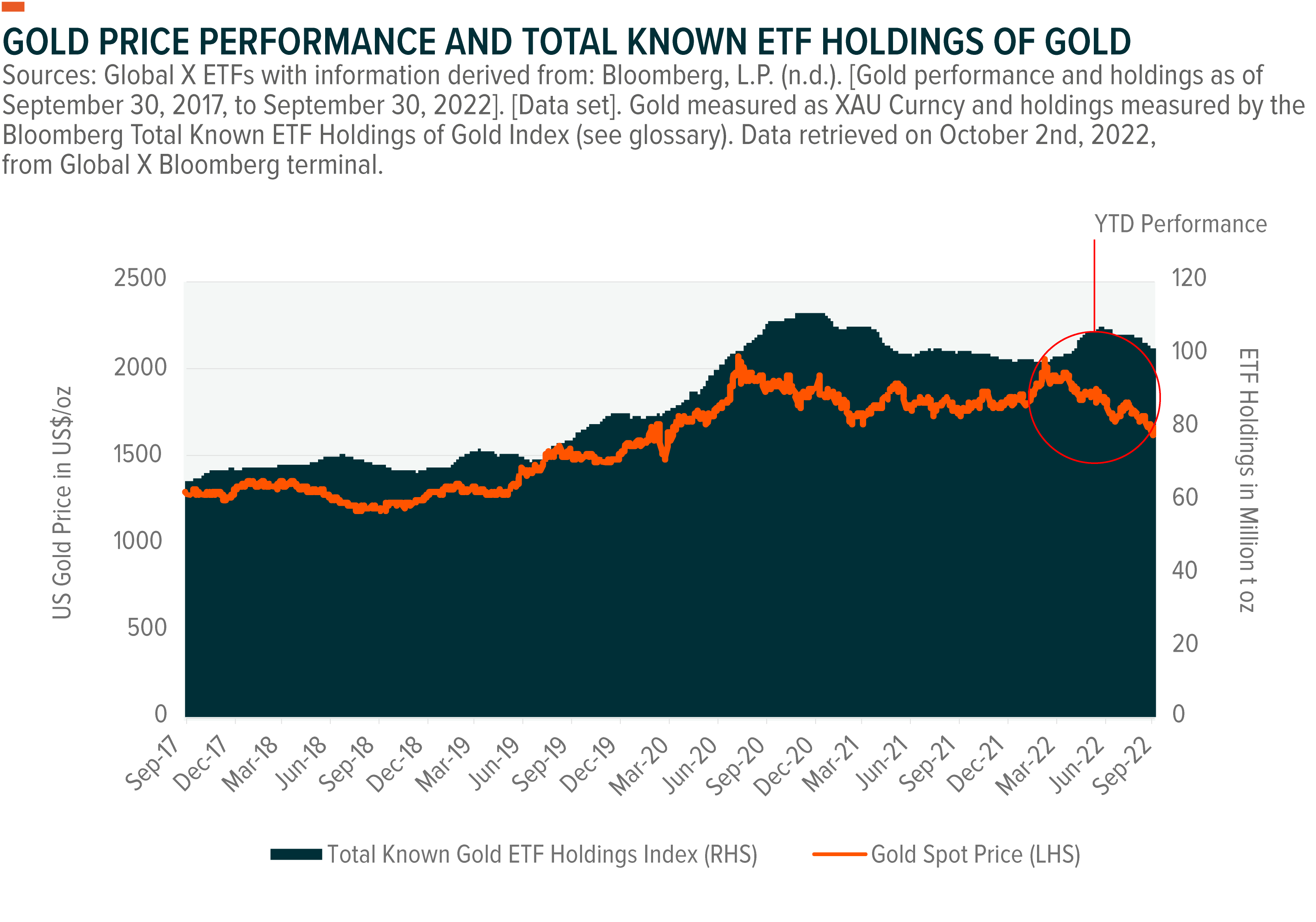

Analyzing historical trends and patterns is a fundamental step in forecasting the Gold Price Outlook. Examining how gold prices have reacted to economic events, geopolitical tensions, and market conditions in the past provides valuable insights. Investors can identify recurring patterns that may help anticipate future price movements and make strategic decisions.

Global Economic Indicators

The Gold Price Outlook is intricately tied to global economic indicators. Economic factors such as inflation rates, interest rates, and overall economic health play a significant role in shaping gold prices. Understanding how these indicators interplay allows investors to gauge the broader economic context and make predictions about the future direction of gold prices.

Geopolitical Influences on Gold Prices

Geopolitical events can have a profound impact on the Gold Price Outlook. Uncertainties stemming from political tensions, trade disputes, or international conflicts often drive investors towards safe-haven assets like gold. Keeping a close eye on geopolitical developments is essential for investors looking to anticipate potential shifts in the gold market.

Market Sentiment and Speculation

Market sentiment and speculative activities can create fluctuations in the Gold Price Outlook. Investor sentiment, influenced by news, market rumors, or macroeconomic trends, can drive short-term price movements. Understanding the psychology behind market sentiment enables investors to navigate the gold market more effectively and make informed decisions.

Supply and Demand Dynamics

Supply and demand dynamics are fundamental factors influencing the Gold Price Outlook. Changes in mining production, central bank reserves, and consumer demand for gold jewelry contribute to fluctuations in prices. Investors need to stay informed about these supply and demand fundamentals to anticipate potential shifts in the gold market.

Gold Price Outlook is a critical consideration for investors seeking to navigate the complexities of the financial landscape.

Inflation Hedge and Currency Movements

Gold is often seen as a hedge against inflation, and its price tends to rise when inflation is a concern. Additionally, currency movements, especially the strength or weakness of the U.S. dollar, can impact the Gold Price Outlook. Investors closely monitor inflation rates and currency trends to make strategic decisions about their gold holdings.

Role of Central Banks

Central banks, as significant players in the global economy, can influence the Gold Price Outlook through their gold reserves and monetary policies. Changes in central bank attitudes towards gold, such as buying or selling activities, can signal broader economic trends. Investors track central bank actions to gain insights into potential shifts in the gold market.

Technological and Industrial Demand

Beyond its role as a financial asset, gold has various industrial applications in technology and manufacturing. The demand for gold in these sectors can influence its price. Understanding the technological and industrial aspects of gold consumption provides investors with a more comprehensive view of the factors contributing to the Gold Price Outlook.

Environmental and Social Factors

Increasing attention to environmental and social factors has also become a consideration in the Gold Price Outlook. Responsible mining practices and ethical sourcing can impact investor perceptions and, consequently, gold prices. Investors interested in sustainable and socially responsible investment practices may factor these considerations into their assessments of the gold market.

Strategies for Investors in a Shifting Landscape

Given the multifaceted nature of factors influencing the Gold Price Outlook, investors need effective strategies to navigate this shifting landscape. Diversification, staying informed about global economic trends, and utilizing resources such as the Gold Price Outlook are essential components of a robust approach. Investors should also remain adaptable, adjusting their strategies in response to evolving market conditions.

In conclusion, understanding and navigating the Gold Price Outlook requires a comprehensive analysis of historical trends, economic indicators, geopolitical influences, and market dynamics. Investors who stay informed and adopt strategic approaches are better positioned to make informed decisions in the dynamic world of gold investments.