Deciphering Gold Prices: In-Depth Analysis

Decoding Trends: An In-Depth Journey into Gold Price Analysis

Understanding the dynamics of gold prices is crucial for investors seeking to make informed decisions in the ever-changing landscape of financial markets. In this exploration, we delve into the intricacies of gold price analysis, examining the factors that influence its value, historical trends, and strategies for navigating this precious metal’s price movements.

Factors Influencing Gold Prices

Gold prices are influenced by a myriad of factors, each playing a unique role in shaping market dynamics. Economic indicators, such as inflation rates and interest rates, geopolitical events, and currency movements all contribute to the ebb and flow of gold prices. Analyzing these factors is essential for a comprehensive understanding of gold price movements.

Macroeconomic Indicators and Gold Price Movements

Macroeconomic indicators serve as barometers for gold price movements. Inflation erodes the purchasing power of currencies, often leading investors to turn to gold as a store of value. Interest rates also play a pivotal role; when rates are low, the opportunity cost of holding gold diminishes, making it a more attractive investment.

Geopolitical Events and Safe-Haven Demand

Geopolitical events can trigger fluctuations in gold prices, especially when uncertainty prevails in global markets. Gold is often viewed as a safe-haven asset during times of political unrest or economic instability. Understanding the impact of geopolitical events on investor sentiment is key to anticipating potential shifts in gold prices.

Currency Movements and Gold as a Global Commodity

Gold is a global commodity traded in various currencies. Currency movements, including exchange rate fluctuations, influence the value of gold. A weaker currency often leads to an increase in gold prices as investors seek to preserve wealth. Monitoring currency trends provides valuable insights into the future direction of gold prices.

Historical Trends: A Guide to Future Movements

Analyzing historical trends is fundamental to gold price analysis. Historical data provides a roadmap of how gold prices have responded to different market conditions over time. Examining patterns and correlations enables investors to make more informed predictions about potential future movements in the gold market.

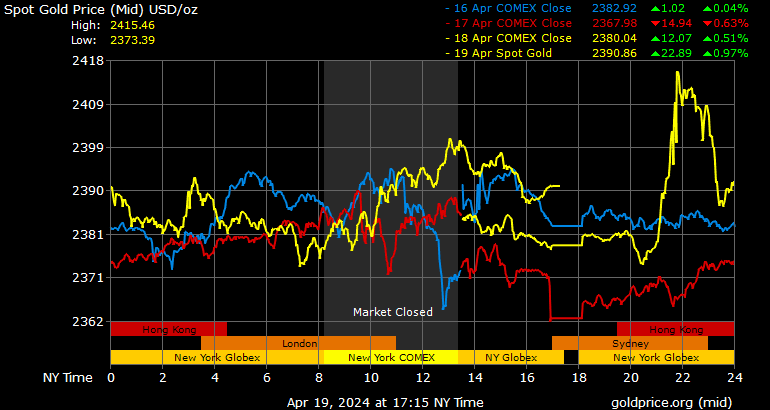

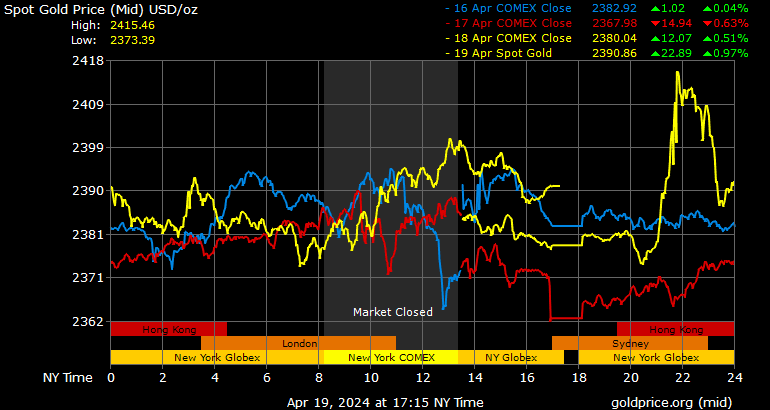

Technical Analysis Tools and Chart Patterns

Technical analysis tools, such as charts and indicators, are essential for conducting thorough gold price analysis. Chart patterns, such as head and shoulders, triangles, and trendlines, offer insights into potential trend reversals or continuations. Investors use these tools to identify entry and exit points based on historical price movements.

Market Sentiment and Gold Price Swings

Market sentiment plays a significant role in gold price swings. Fear, optimism, and risk aversion can drive sudden fluctuations. Monitoring sentiment indicators, including investor positioning and market surveys, provides a qualitative dimension to gold price analysis. Understanding sentiment helps investors gauge potential market moves.

Gold Price Forecasting and Predictive Models

Gold price forecasting involves using various predictive models based on historical data, statistical analyses, and economic indicators. While no model can predict with absolute certainty, these tools offer valuable insights into potential future trends. Investors use forecasting as part of their decision-making process in the gold market.

Risk Management Strategies for Gold Investments

Given the inherent volatility of financial markets, risk management is paramount in gold price analysis. Diversification, setting clear risk tolerance levels, and employing stop-loss orders are common strategies to mitigate risks. Understanding the factors that contribute to gold price movements enhances the effectiveness of risk management strategies.

Strategies for Navigating Gold Price Fluctuations

Navigating gold price fluctuations requires a strategic approach. Long-term investors may focus on fundamental analysis, while short-term traders often incorporate technical analysis. Adaptive strategies that consider both short-term trends and long-term fundamentals empower investors to navigate the dynamic nature of gold prices effectively.

To explore more insights into Gold Price Analysis, visit Gold Price Analysis. This resource provides additional tools and perspectives to assist investors in deciphering the intricacies of gold prices, making informed decisions, and unlocking the potential for optimal returns.